http www.clark.com smart-strategies-to-pay-off-credit-card-debt Option 1: Look Into Balance Transfer Offers. Option 2: Consider a Debt Consolidation Loan. Option 3: See a Certified Debt Counselor. Two Things You Don’t Want to Do When Consolidating Credit Card Debt. Level 1. 15 points. Jan 2, 2020 4:47 PM in response to deggie. the iPhone 7 supports reading and writing of NFC tags through third party apps, such as TagWriter. A business I deal with now .

0 · how to solve credit card debt

1 · how to pay off credit card debt

2 · how to pay off credit card

3 · how to eliminate credit card debt

4 · credit card debt elimination strategies

5 · credit card debt elimination plan

6 · credit card debt elimination

7 · clark howard credit card debt

$18.99

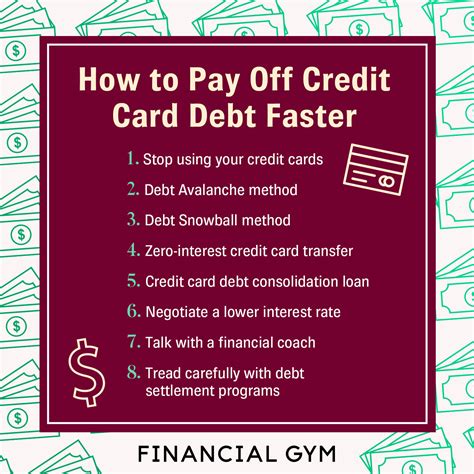

From debt snowball to debt avalanche, many nifty-named and impactful strategies can empower you to kill off these high-interest charges once and for all. Each strategy has its .

From debt snowball to debt avalanche, many nifty-named and impactful strategies can empower you to kill off these high-interest charges once and for all. Each strategy has its pros and cons, so you’re probably wondering which you .One of the easiest ways to expedite paying off credit card debt is to lower your interest rate. You can do this by getting a balance transfer credit card . But to do this, your credit score will need to be high enough to qualify for such a card.

Option 1: Look Into Balance Transfer Offers. Option 2: Consider a Debt Consolidation Loan. Option 3: See a Certified Debt Counselor. Two Things You Don’t Want to Do When Consolidating Credit Card Debt.

How to get out of credit card debt: 1. Find a payment strategy. 2. Look into debt consolidation. 3. Talk with your creditors. 4. Look into debt relief. 5. Lower your living expenses. Explore these 10 credit card debt payoff strategies—and find out the best way to pay off credit card debt fast. Revolving credit card debt can hurt your credit score and, even worse, be very expensive. But there are a few payoff strategies you can try.

Just as no credit card is right for everyone, there's no universally correct order of paying off bills to become debt-free — despite conflicting advice from money gurus. Yet, your choice could. Paying off credit card debt can be complicated — and if you only put money toward your remaining balance, you might make a huge mistake. Here's how to avoid it. If you’ve found yourself struggling with credit card debt and are worried it’s impacting your credit, don’t panic — there’s a way out. Here are some strategies to pay it off and get your financial life back on track. Avalanche method. The avalanche strategy is a popular way to eliminate credit card debt. It focuses on paying off .

The best way to pay off credit card debt is as soon as possible. And you can save both time and money by using a credit card payoff calculator as well as a 0% balance transfer credit card, if you have good or excellent credit. You can check your latest credit score for free on WalletHub to find out. From debt snowball to debt avalanche, many nifty-named and impactful strategies can empower you to kill off these high-interest charges once and for all. Each strategy has its pros and cons, so you’re probably wondering which you .One of the easiest ways to expedite paying off credit card debt is to lower your interest rate. You can do this by getting a balance transfer credit card . But to do this, your credit score will need to be high enough to qualify for such a card.Option 1: Look Into Balance Transfer Offers. Option 2: Consider a Debt Consolidation Loan. Option 3: See a Certified Debt Counselor. Two Things You Don’t Want to Do When Consolidating Credit Card Debt.

How to get out of credit card debt: 1. Find a payment strategy. 2. Look into debt consolidation. 3. Talk with your creditors. 4. Look into debt relief. 5. Lower your living expenses. Explore these 10 credit card debt payoff strategies—and find out the best way to pay off credit card debt fast.

how to solve credit card debt

Revolving credit card debt can hurt your credit score and, even worse, be very expensive. But there are a few payoff strategies you can try. Just as no credit card is right for everyone, there's no universally correct order of paying off bills to become debt-free — despite conflicting advice from money gurus. Yet, your choice could. Paying off credit card debt can be complicated — and if you only put money toward your remaining balance, you might make a huge mistake. Here's how to avoid it. If you’ve found yourself struggling with credit card debt and are worried it’s impacting your credit, don’t panic — there’s a way out. Here are some strategies to pay it off and get your financial life back on track. Avalanche method. The avalanche strategy is a popular way to eliminate credit card debt. It focuses on paying off .

details of smart card public service vehicle driver badge

digital smart card keyless door lock

how to pay off credit card debt

how to pay off credit card

$26.99

http www.clark.com smart-strategies-to-pay-off-credit-card-debt|how to solve credit card debt