smart money card application branches Secure and FDIC insured up to $250,000 § Live customer support 7 days a week 55,000+ no-fee ATMs worldwide** Track your bills, spending and subscriptions Start using your . See more If you see an NFC notification on your phone, you have two options: swipe it away or tap on it. Swiping it away will dismiss the notification and stop any action from happening. .

0 · How Does Experian Smart Money™ Work?

1 · Experian Smart Money™ Digital Checking Account FAQ

2 · Experian Smart Money™

Hey! Since I've upgraded my phone today from X to 12 Pro the NFC reader is gone. I can't activate or find it anymore.

Pay bills like your rent, utilities and streaming services with your digital checking account and we'll find payments that could instantly raise your credit scores. Ø ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian . See more

You can get a bonus when you set up direct deposit. ‡ Plus, paydays get even better with paychecks hitting your account up to 2 days early. † See more1 Sign up now Enroll in a free membership and open a digital checking account through Experian 2 Download the free app It’s your go-to place to easily manage your account, check your credit and more. Scan to get the Experian app 3 Start depositing money Add money . See more

Not a fan of fees? Neither are we! So you won't pay monthly fees, and you're never charged for a Secure and FDIC insured up to 0,000 § Live customer support 7 days a week 55,000+ no-fee ATMs worldwide** Track your bills, spending and subscriptions Start using your . See more account balance. ¶ See more

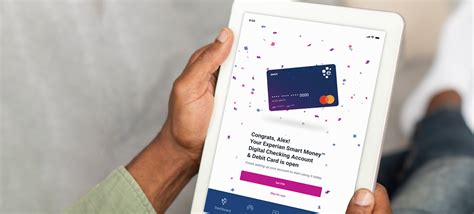

Use your Experian Smart Money™ Debit Card to get cash at 55,000+ in-network, surcharge-free ATMs in the Allpoint network worldwide.** To find your nearest ATM, search Allpoint locations . Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay .Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.

Use your Experian Smart Money™ Debit Card to get cash at 55,000+ in-network, surcharge-free ATMs in the Allpoint network worldwide.** To find your nearest ATM, search Allpoint locations . To deposit cash # , bring your card to a retail store in the Mastercard rePower ® cash load network. Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. How to open the Experian Smart Money account. Since Experian isn’t a bank, there aren’t any physical branches you can visit to open the Smart Money account. You can open the account online with these simple steps: Follow the link to .

USU Credit Union Smart Money was built to help you along your journey toward financial freedom. Smart Money allows members to set and track financial goals, assess financial attitudes and behaviors, earn course completion certificates, and much more. Explore Experian Smart Money, a checking account and debit card with financial tools that help you build your credit by making on-time bill payments. Pros. Ability to build credit with eligible on-time payments. No monthly or minimum balance fees. Early direct deposit. Access to financial tools available with Experian membership. Cons. No. Experian’s Smart Money Digital Checking account comes with no minimum balance requirements or monthly fees. While that’s a nice start, the checking account really stands out by offering a way to build your credit without taking on debt.

Use your FNB SmartCash SM Credit Card 1 to make everyday purchases and watch the rewards add up. Earn 2% cash back rewards on all qualified purchases. 2 Enjoy the flexibility to either redeem the rewards directly into your FNB checking account, or turn them into gift cards for a vast array of popular retailers and services. 3. South Africans looking for a more convenient way to apply for and receive their Smart IDs and passports are still limited to only 30 branches across major banks to do so.

How Does Experian Smart Money™ Work?

Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.Use your Experian Smart Money™ Debit Card to get cash at 55,000+ in-network, surcharge-free ATMs in the Allpoint network worldwide.** To find your nearest ATM, search Allpoint locations . To deposit cash # , bring your card to a retail store in the Mastercard rePower ® cash load network. Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. How to open the Experian Smart Money account. Since Experian isn’t a bank, there aren’t any physical branches you can visit to open the Smart Money account. You can open the account online with these simple steps: Follow the link to .

logos smart card reader

USU Credit Union Smart Money was built to help you along your journey toward financial freedom. Smart Money allows members to set and track financial goals, assess financial attitudes and behaviors, earn course completion certificates, and much more. Explore Experian Smart Money, a checking account and debit card with financial tools that help you build your credit by making on-time bill payments.

Pros. Ability to build credit with eligible on-time payments. No monthly or minimum balance fees. Early direct deposit. Access to financial tools available with Experian membership. Cons. No.

lg smart tv wireless card

Experian Smart Money™ Digital Checking Account FAQ

Experian’s Smart Money Digital Checking account comes with no minimum balance requirements or monthly fees. While that’s a nice start, the checking account really stands out by offering a way to build your credit without taking on debt.Use your FNB SmartCash SM Credit Card 1 to make everyday purchases and watch the rewards add up. Earn 2% cash back rewards on all qualified purchases. 2 Enjoy the flexibility to either redeem the rewards directly into your FNB checking account, or turn them into gift cards for a vast array of popular retailers and services. 3.

Experian Smart Money™

note picopass is a 13.56 protocol device so if the UID was not detected in NFC mode this should not work either, this app can just read more data for tags that NFC can not .

smart money card application branches|Experian Smart Money™ Digital Checking Account FAQ